How to Prepare Financial Statements for Investors

When you’re looking to raise capital for your business, financial statements become one of the most powerful tools at your disposal. These documents are more than just numbers—they’re your story. Investors rely on them to assess your company’s financial health, profitability, and potential for growth. If you want investors to take your business seriously, it’s crucial to prepare your financial statements accurately and strategically.

In this guide, we will explore how to prepare financial statements for investors, discuss what investors are looking for, and provide best practices to make your financials compelling and trustworthy. Whether you’re a startup seeking seed funding or an established business aiming for Series B, understanding the process of preparing financial statements is vital to attracting the right investment.

Why Financial Statements Matter to Investors

Financial statements are essential for investors to understand the financial health of a business. Without them, there’s no way for investors to know if your business is capable of generating returns or if it’s at risk of financial failure. Here’s why they matter:

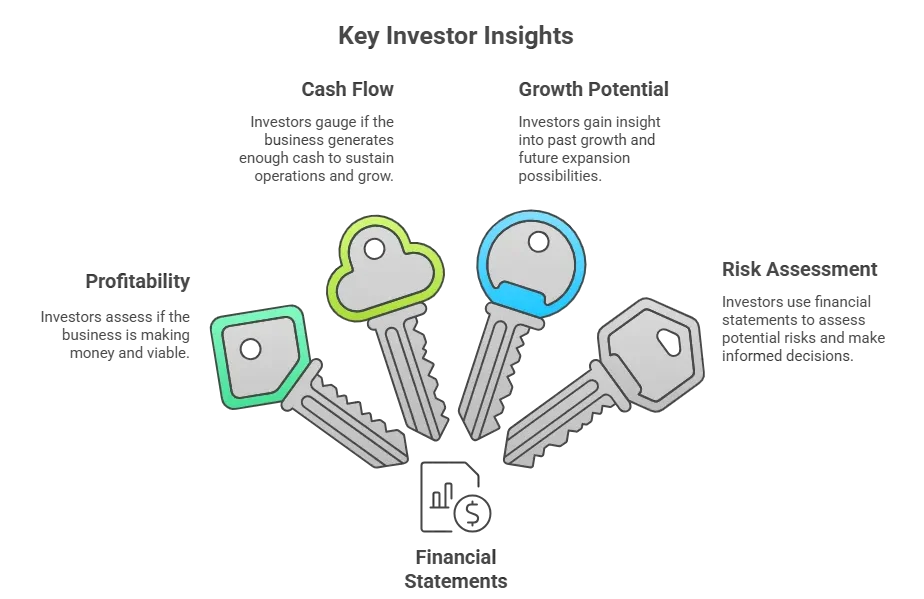

- Profitability: Investors need to see if your business is making money. Without a clear picture of profitability, investors cannot determine the viability of your business.

- Cash Flow: Cash is king in business. Investors rely on your cash flow statement to gauge whether your business is generating enough cash to sustain operations and grow.

- Growth Potential: Financial statements give investors insight into how your business has grown and its potential for future expansion.

- Risk Assessment: Investors use financial statements to assess potential risks and make informed decisions.

By preparing your financial statements properly, you demonstrate credibility, reliability, and transparency—qualities that investors look for when deciding where to allocate their capital.

What Financial Statements Do Investors Want to See?

Investors generally look for three key financial documents when evaluating a business:

1. Profit and Loss (P&L) Statement

The P&L statement provides a detailed look at your business’s revenues, expenses, and net income over a specific period. Investors will scrutinize this document to understand whether your business is making a profit and how efficiently it’s managing its costs.

2. Balance Sheet

The balance sheet gives investors a snapshot of your business’s financial health by showing your assets, liabilities, and equity at a specific point in time. This document is vital because it helps investors assess your financial stability and capital structure.

3. Cash Flow Statement

The cash flow statement tracks the flow of cash in and out of your business. Investors rely heavily on this statement to understand whether your business can cover its operational costs and fund its growth without running into liquidity issues.

How to Prepare Financial Statements for Investors

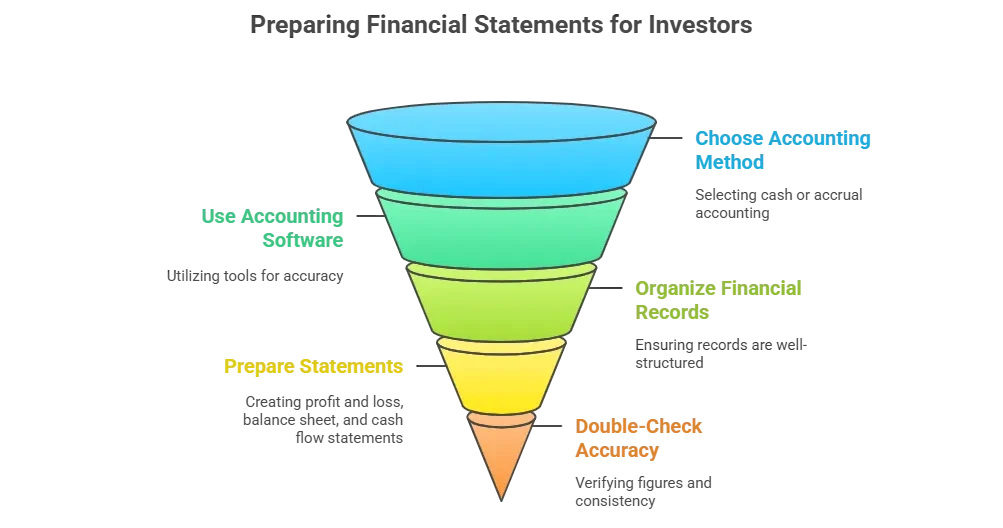

Preparing financial statements for investors requires a systematic approach. Let’s break it down step by step.

Step 1: Choose an Accounting Method

Before you start preparing your financial statements, you need to choose an accounting method. There are two primary methods:

- Cash Accounting: This method records transactions when cash changes hands. It’s simpler but less accurate for long-term analysis.

- Accrual Accounting: This method records revenues and expenses when they are incurred, not when cash is exchanged. It’s the preferred method for most investors because it provides a more accurate view of your business’s financial health.

Step 2: Use Accounting Software or Hire an Accountant

While it’s possible to prepare financial statements manually, it’s much easier to use accounting software like QuickBooks or Xero. These tools streamline the process and ensure accuracy. If you’re not confident in your ability to prepare the statements yourself, consider hiring an accountant with experience in your industry.

Step 3: Get Your Financial Records Organized

Investors want to see well-organized financial records. This includes:

- Bank Statements: To verify cash flow and bank balances.

- Sales and Expense Receipts: To cross-check revenue and costs.

- Payroll Records: To ensure employee compensation is accurately reported.

- Loan and Lease Agreements: To assess liabilities.

- Tax Documents: To validate your compliance and obligations.

Step 4: Prepare Each Statement

- Profit and Loss Statement: Begin by listing all your revenues and expenses. Subtract your expenses from your revenue to calculate your net income.

- Balance Sheet: List all your assets (current and non-current), liabilities (current and non-current), and equity. Ensure that your assets equal your liabilities plus equity.

- Cash Flow Statement: Start with your beginning cash balance, then add cash from operations, investing activities, and financing activities. Subtract your cash outflows to arrive at your ending cash balance.

Step 5: Double-Check for Accuracy

Once you’ve prepared your financial statements, double-check every figure. Mistakes in your statements can erode investor trust. Ensure consistency across all documents and verify that everything adds up correctly.

Best Practices for Investor-Ready Financial Statements

To ensure your financial statements are investor-friendly, follow these best practices:

Keep It Simple and Straightforward

Investors don’t have time to dig through complex jargon. Use clear, simple language and avoid unnecessary complexity. This will make your financial statements easy to understand.

Show Financial Comparisons

Investors want to see growth. Include comparisons to previous periods to highlight improvements in revenue, profitability, and cash flow. This will give investors confidence in your ability to grow sustainably.

Provide Context

Don’t just present numbers—explain them. If there’s a one-off expense or a revenue spike, make sure to explain why. Providing context helps investors understand the reasons behind the numbers.

Use Visuals

Graphs and charts can make your financial statements easier to digest. Use visuals to highlight key data points like revenue growth, profitability, and cash flow trends.

Common Financial Statement Mistakes to Avoid

To ensure your financial statements are up to par, avoid these common mistakes:

1. Forgetting Cash Flow

While your business may appear profitable on paper, a lack of liquidity can be a major red flag for investors. Always include detailed cash flow statements to give investors a clear view of your cash situation.

2. Overstating Revenue or Underestimating Expenses

Be realistic with your projections. Inflating revenue or understating expenses can mislead investors and damage your credibility.

3. Ignoring Liabilities

Your financial statements should present a full picture of your business, including any debts or obligations. Be transparent about your liabilities to avoid surprises that could scare investors away.

FAQs About Preparing Financial Statements for Investors

Conclusion

Preparing financial statements for investors is a crucial step in raising capital and building trust with potential investors. By ensuring accuracy, clarity, and context, you can present your business in the best light possible. Remember, these documents are more than just numbers—they’re a reflection of your business’s potential.

If you’re ready to get your financial statements in order and take your business to the next level, follow these steps, and consider seeking professional help if necessary. The right financials can make all the difference in securing the investment you need.