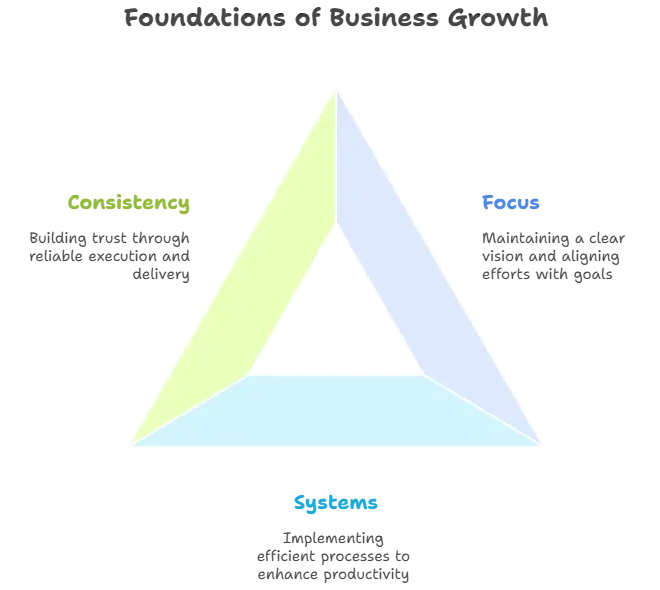

The Business Growth Equation: Focus, Systems, Consistency

Your Roadmap to Sustainable Business Growth

Running a business in 2025 feels like navigating a stormy sea—economic uncertainty, shifting consumer trends, and fierce competition can make growth seem elusive. But what if you had a business growth formula that works no matter the economic climate? Whether you’re a startup founder, small business owner, or seasoned entrepreneur, the right strategies can turn challenges into opportunities. From optimizing your value proposition to mastering financial forecasting, this guide offers a blueprint for sustainable growth that delivers profits and resilience.

Drawing from proven frameworks and real-world success stories, we’ll explore the four pillars of growth, key metrics, and actionable tactics to scale your business in 2025. Expect practical insights, stats, and examples to help you outgrow competitors and build a thriving enterprise. Let’s get started!

What Is the Business Growth Formula?

The business growth formula is a strategic framework that combines mindset, systems, and tactics to drive sustainable revenue and profitability. It’s not a one-size-fits-all solution but a set of principles that adapt to any industry or economic condition. At its core, the formula focuses on delivering value, acquiring and retaining customers, and optimizing operations while leveraging data-driven insights like financial forecasting.

Key Components of the Growth Formula

- Mindset: Embracing calculated risks and viewing setbacks as learning opportunities.

- Systems: Building scalable processes for customer acquisition, operations, and performance tracking.

- Metrics: Monitoring leading and lagging indicators to ensure profitable growth.

- Leadership: Aligning vision, team, and strategy to execute with discipline.

Real-World Example: A UK-based tech startup used this formula to double its revenue in 2024 by refining its core offer, systematizing lead generation, and forecasting cash flow to fund expansion.

Why Business Growth Matters in Any Economy

Sustainable growth isn’t just about getting bigger—it’s about building a resilient business that thrives through uncertainty. Here’s why mastering growth strategies is critical in 2025:

Boosts Profitability

A 2022 McKinsey study found that companies with 5% higher annual revenue growth generate 3–4% more total shareholder returns (TSR), equating to a 33–45% market cap increase over a decade. Consistent growth fuels profits, enabling reinvestment in innovation or expansion.

Enhances Resilience

Growth strategies like diversification and operational efficiency help businesses weather economic downturns. For example, a retail chain that diversified into e-commerce in 2023 maintained profitability despite high street slowdowns.

Attracts Investors

Investors prioritize businesses with clear growth plans. 78% of investors in a 2024 PwC survey favored companies with robust forecasting and growth models, making them more likely to secure funding.

Drives Competitive Advantage

Outgrowing your industry peers signals a strong business model. McKinsey’s research shows that companies that outpace competitors by 1% annually achieve 5% higher TSR, unlocking market leadership.

Case Study: Absolute Aviation, an African aviation firm, used a growth formula to scale from a consultancy to a regional leader by streamlining operations and forecasting demand, acquiring competitors in 2024.

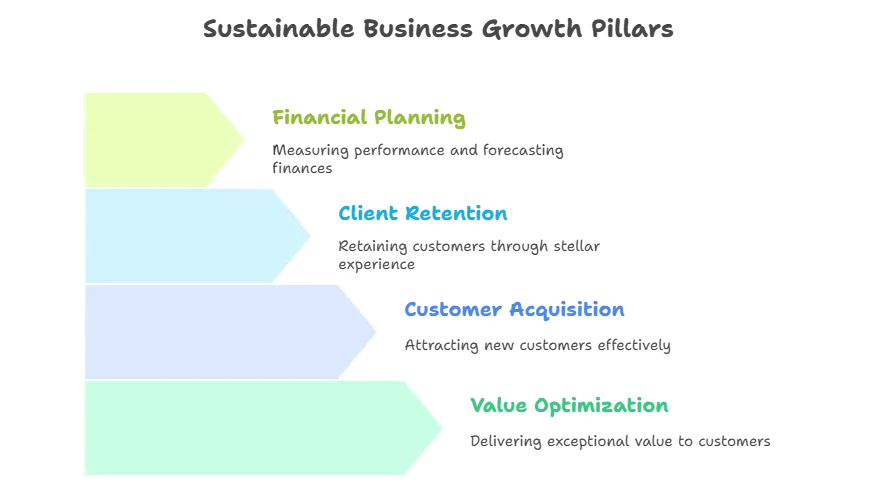

The Four Pillars of Sustainable Business Growth

Based on insights from industry experts and successful businesses, sustainable growth rests on four pillars:

Pillar 1: Value Optimization

Delivering exceptional value is the foundation of growth. This means refining your product or service to solve customer problems better than competitors.

- Refine Your Offer: Focus on what sets you apart, like unique features or superior quality.

- Enhance Delivery: Streamline processes to reduce friction, such as faster shipping or better support.

- Create Value Tiers: Offer multiple price points to capture diverse customer segments.

Example: A UK café chain optimized value by introducing a subscription model for daily coffee, increasing customer retention by 25% in 2024.

Pillar 2: Customer Acquisition Systems

A reliable system for attracting new customers is essential for growth. Effective systems are targeted, measurable, and scalable.

- Targeted Messaging: Tailor campaigns to specific customer segments using market research.

- Conversion Pathways: Create clear funnels, like webinars or free trials, to convert leads.

- Multi-Channel Approach: Use social media, email, and paid ads for predictable results.

Stat: Businesses with systematized acquisition strategies saw 30% higher lead conversion rates in a 2024 HubSpot report.

Pillar 3: Client Experience and Retention

Retaining customers is cheaper than acquiring new ones—by up to 5 times, per a 2023 Bain & Company study. A stellar client experience drives loyalty and referrals.

- Exceed Expectations: Surprise customers with personalized support or bonuses.

- Systematic Check-Ins: Schedule regular touchpoints to nurture relationships.

- Upsell Opportunities: Offer premium services to increase lifetime value.

Example: A SaaS company improved retention by 20% in 2024 by implementing monthly check-ins and an ascension model for upgrades.

Pillar 4: Performance Metrics and Financial Planning

You can’t grow what you don’t measure. Financial forecasting and key performance indicators (KPIs) ensure you stay on track.

- Track KPIs: Monitor metrics like revenue growth, customer acquisition cost (CAC), and cash flow.

- Forecast Cash Flow: Predict inflows and outflows to avoid shortfalls.

- Adjust Strategies: Use data to pivot when markets shift.

Case Study: ADA Consulting Engineers, an African firm, used forecasting to tighten financial controls, increasing profitability by 15% in 2024.

Financial Forecasting: The Backbone of Growth

Financial forecasting is a critical tool within the growth formula, providing data-driven insights to guide decisions. By predicting revenue, expenses, and cash flow, it supports all four pillars.

Types of Financial Forecasting

- Cash Flow Forecasting: Ensures liquidity by tracking cash inflows and outflows.

- Sales Forecasting: Predicts revenue to set realistic sales targets.

- Income Statement Forecasting: Projects profits and expenses for strategic planning.

- Rolling Forecasts: Updates projections regularly for flexibility in volatile markets.

Stat: 70% of FP&A teams adopted rolling forecasts in 2024, per a financial software survey, for their adaptability in dynamic industries.

How Forecasting Drives Growth

- Informs Budgeting: Aligns spending with growth goals, like hiring or marketing.

- Mitigates Risks: Identifies potential challenges, such as market downturns.

- Supports Expansion: Predicts cash needs for new markets or acquisitions.

Example: A UK logistics firm used rolling forecasts to adjust for 2024 fuel cost spikes, saving £200,000 by optimizing routes.

Key Strategies for Business Growth in 2025

Beyond the four pillars, specific tactics can accelerate growth in any economy:

Strategic Partnerships

Collaborate with complementary businesses to access new audiences. McKinsey’s 2022 study found that companies with strong partnerships grew 1–2% faster annually.

- Identify non-competing firms serving your target market.

- Create joint offerings, like bundled services.

- Develop referral systems for mutual benefit.

Example: A UK fitness app partnered with a health food brand in 2024, boosting downloads by 30% through cross-promotion.

Market Segmentation

Focus on high-value customer segments to maximize efficiency. Targeted campaigns can reduce acquisition costs by 20%, per a 2024 Forrester report.

- Analyze customer behavior and demographics.

- Tailor messaging to each segment’s needs.

- Allocate resources to high-potential groups.

Programmatic Acquisitions

Small, frequent acquisitions can drive growth without high risk. Programmatic acquirers outperformed organic growers by 2% in TSR, per McKinsey’s 2022 research.

- Target businesses that enhance your core or adjacencies.

- Build M&A expertise through consistent deals.

- Integrate acquisitions seamlessly to retain value.

Case Study: A European publisher acquired 60+ digital media firms over a decade, growing digital revenue to 70% of total sales by 2024.

Recurring Revenue Models

Predictable revenue stabilizes cash flow and increases valuation. Businesses with recurring revenue are valued 2–3 times higher, per a 2023 SaaS Capital study.

- Offer subscriptions or memberships.

- Create ascension models for upselling.

- Nurture leads between sales events.

Example: A UK gym chain launched a monthly membership in 2024, increasing revenue predictability by 40%.

Operational Excellence for Scalable Growth

Operational excellence ensures your business can scale without collapsing under its own weight. It’s about efficient processes and smart resource allocation.

Streamline Processes

- Document workflows to ensure consistency.

- Automate repetitive tasks, like invoicing or email follow-ups.

- Eliminate bottlenecks, such as slow approvals.

Leverage Technology

- Use CRM tools for customer data management.

- Implement financial planning software for accurate forecasting.

- Adopt analytics for real-time insights.

Stat: 82% of businesses using FP&A software improved forecast accuracy by 20%, per a 2024 Gartner report.

Example: A UK retailer automated inventory tracking in 2024, reducing stockouts by 15% and saving £100,000 annually.

Leadership: The Heart of the Growth Formula

You the Leader is the first pillar for a reason—your business grows only as much as you do. Strong leadership aligns vision, inspires teams, and drives execution.

Key Leadership Traits

- Adaptability: Pivot strategies based on market shifts.

- Empathy: Build trust with employees and customers.

- Decisiveness: Make tough calls to prioritize growth.

Developing a Growth Mindset

- Embrace calculated risks, like entering new markets.

- Learn from failures to refine strategies.

- Challenge industry norms to innovate.

Case Study: A UK startup founder attended leadership coaching in 2024, improving team alignment and driving a 20% revenue increase.

FAQs: Your Business Growth

Conclusion: Build Your Growth Engine

The business growth formula is your blueprint for thriving in 2025, no matter the economic climate. By mastering the four pillars—value optimization, customer acquisition, client experience, and performance metrics—and leveraging tactics like financial forecasting, strategic partnerships, and recurring revenue, you can build a resilient, profitable business. Start small but think big: focus on one pillar or tactic, like streamlining operations or forecasting cash flow, and watch momentum build.