The Ultimate Guide to Financial Forecasting for Business Success

Why Financial Forecasting Is Your Business’s Secret Weapon

Imagine running a business without knowing what’s around the corner—cash flow hiccups, unexpected expenses, or missed growth opportunities. Scary, right? Financial forecasting is like a GPS for your business, guiding you through uncertainty with data-driven predictions. By leveraging historical data, market trends, and smart tools, you can make informed decisions, manage risks, and unlock growth potential. Whether you’re a startup founder, CFO, or small business owner, mastering financial forecasting can stabilize cash flow, attract investors, and set you up for long-term success in 2025 and beyond.

In this guide, we’ll break down what financial forecasting is, why it matters, and how to implement it effectively. From types and methods to cutting-edge tools, we’ve got you covered with actionable insights and real-world examples. Let’s dive in!

What Is Financial Forecasting?

Financial forecasting is the process of estimating future financial outcomes—revenue, expenses, cash flow, and more—based on historical data, current trends, and market conditions. It’s a cornerstone of financial planning and analysis (FP&A), empowering businesses to anticipate challenges, allocate resources wisely, and set realistic goals.

How Financial Forecasting Works

Forecasting combines quantitative data (like past sales figures) with qualitative insights (like market trends or expert opinions). For example, a retail business might analyze last year’s holiday sales and current consumer trends to predict Q4 revenue. This blend of data and intuition helps businesses plan for both expected events (e.g., seasonal demand) and unexpected disruptions (e.g., supply chain issues).

Key Components of Financial Forecasting

- Historical Data: Past performance from income statements, balance sheets, and cash flow statements.

- Market Trends: Economic conditions, industry shifts, or consumer behavior changes.

- Assumptions: Educated guesses about future events, like inflation rates or new product launches.

- Scenario Planning: Preparing for best-case, worst-case, and likely outcomes.

Real-World Example: A SaaS startup uses historical subscription data and market growth rates to forecast monthly recurring revenue (MRR) for 2025, helping them decide whether to hire new staff or invest in marketing.

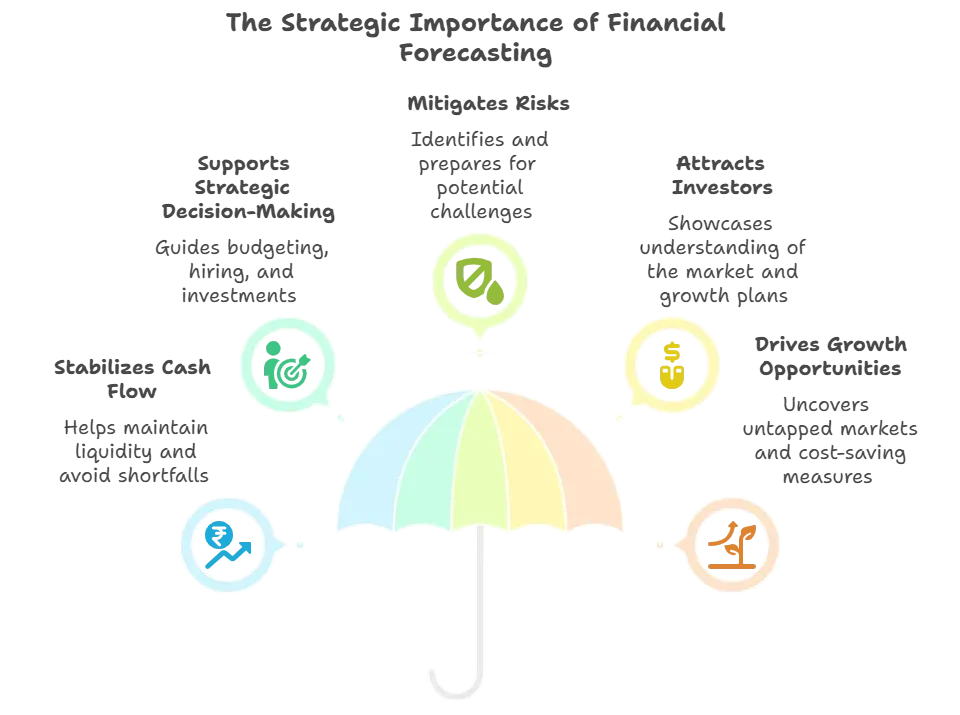

Why Financial Forecasting Matters for Your Business

Financial forecasting isn’t just number-crunching—it’s a strategic tool that drives better decisions and business growth. Here’s why it’s critical:

Stabilizes Cash Flow

Cash flow disruptions can cripple a business. Forecasting cash inflows and outflows helps you avoid shortfalls and maintain liquidity. For instance, a 2023 survey by the Chartered Institute of Management Accountants found that 65% of businesses with strong forecasting practices reported stable cash flow compared to those relying on ad-hoc planning.

Supports Strategic Decision-Making

Forecasting provides a roadmap for budgeting, hiring, and investments. Department heads can align spending with goals, while procurement teams plan inventory based on predicted demand. For example, a manufacturing firm might use sales forecasts to optimize production schedules, reducing waste.

Mitigates Risks

By identifying potential risks—like market volatility or operational inefficiencies—forecasting helps you create contingency plans for risk management. Scenario analysis, such as stress-testing for a 10% sales drop, can prepare you for unexpected challenges.

Attracts Investors

Investors love data-driven businesses. Detailed financial projections show you understand your market and have a plan for growth. A 2024 PwC report noted that 78% of investors prioritize companies with robust forecasting models when making funding decisions.

Drives Growth Opportunities

Forecasting uncovers opportunities, like untapped markets or cost-saving measures. For instance, a retail chain might identify a seasonal sales spike and allocate more budget to marketing during that period.

Case Study: A UK-based e-commerce startup used rolling forecasts to predict a 20% sales increase during Black Friday 2024. By adjusting inventory and marketing budgets, they boosted revenue by £500,000 compared to the previous year.

Types of Financial Forecasting

There are several forecasting models, each suited to different business needs and timeframes. Here’s a breakdown:

1. Cash Flow Forecasting

Tracks the inflow and outflow of cash to ensure liquidity. Essential for startups or seasonal businesses to avoid cash shortages.

2. Sales Forecasting

Predicts future revenue based on past sales, market trends, and seasonality. Ideal for setting sales targets and marketing budgets.

3. Income Statement Forecasting

Projects revenues, expenses, and profits, offering a holistic view of financial performance.

4. Balance Sheet Forecasting

Estimates future assets, liabilities, and equity, providing a snapshot of financial health.

5. Rolling Forecasts

A dynamic approach that updates projections regularly (e.g., quarterly), allowing flexibility in volatile markets.

Pro Tip: Rolling forecasts are gaining popularity—70% of FP&A teams adopted them in 2024, per a financial software survey, due to their adaptability in fast-changing industries like tech and retail.

Quantitative vs. Qualitative Forecasting Methods

Forecasting methods fall into two categories: quantitative (data-driven) and qualitative (expert-driven). Here’s how they differ:

Quantitative Forecasting Methods

These rely on historical data and statistical analysis, ideal for businesses with robust records.

- Percent of Sales Forecasting: Calculates items like COGS or inventory as a percentage of sales. For example, if COGS is 30% of sales, a £1M sales forecast predicts £300,000 in costs.

- Straight-Line Method: Projects future revenue based on historical growth rates. Simple but ignores market fluctuations.

- Moving Average: Averages past data (e.g., 3 months) to smooth out trends. Useful for short-term forecasts.

- Linear Regression: Analyzes relationships between variables (e.g., ad spend and sales) for precise predictions.

Example: A café chain uses linear regression to correlate marketing spend with customer visits, forecasting a 15% revenue increase after a £10,000 campaign.

Qualitative Forecasting Methods

These rely on expert insights and market research, perfect for startups or new product launches.

- Delphi Method: Gathers expert opinions through iterative questionnaires to reach a consensus on market trends.

- Market Research: Analyzes competitors, customer behavior, and industry trends to predict demand.

Example: A new fitness app uses market research to forecast demand, identifying a trend toward home workouts and projecting 5,000 downloads in Q1 2025.

Steps to Create an Effective Financial Forecast

Follow these steps to build a robust forecast, inspired by best practices from FP&A experts:

Define Your Goals

Clarify what you’re forecasting—revenue, cash flow, or overall performance. Are you planning for internal budgeting or investor pitches?

Gather Historical Data

Collect financial statements (income, balance sheet, cash flow) and operational data. Ensure accuracy to avoid flawed projections.

Choose a Forecasting Method

Select a method based on data availability. Established businesses might use quantitative methods, while startups lean on qualitative approaches.

Project Future Values

Use your chosen method to estimate future metrics. Incorporate scenario planning for best-case, worst-case, and likely outcomes.

Monitor and Update

Regularly compare forecasts to actual performance and adjust for new data. Rolling forecasts allow continuous updates for agility.

Real-World Example: A UK logistics firm used rolling forecasts to adjust for rising fuel costs in 2024, saving £200,000 by optimizing delivery routes.

How Technology Enhances Financial Forecasting

Modern tools have transformed forecasting from a tedious task to a strategic advantage. Here’s how technology helps:

Real-Time Data Access

Financial planning platforms consolidate financial data, enabling monthly updates instead of quarterly ones. This reduces errors and improves accuracy.

Automation and AI

AI and machine learning automate repetitive tasks and identify patterns. For example, predictive analytics can forecast sales trends based on historical data, improving accuracy by up to 20%.

Collaboration Tools

Software with real-time data sharing improves team collaboration, ensuring forecasts reflect inputs from sales, procurement, and finance teams.

Scenario Analysis

Advanced tools enable sensitivity analysis, letting you test how changes (e.g., a 5% cost increase) impact outcomes.

Stat: A 2024 Gartner report found that 82% of businesses using FP&A software improved forecast accuracy by at least 20%.

Case Study: A retail chain implemented a financial planning tool to centralize data, reducing forecasting errors by 15% and saving £100,000 annually on inventory costs.

Factors Influencing Forecasting Frequency

How often should you forecast? It depends on several factors:

- Industry Volatility: Tech or retail may need monthly forecasts due to rapid changes.

- Business Lifecycle: Startups require frequent forecasts to monitor cash flow, while established firms can forecast quarterly.

- Seasonality: Seasonal businesses like hospitality need frequent updates to capture demand spikes.

- Data Availability: Access to real-time data supports more frequent forecasting.

- Resource Constraints: Small businesses may forecast less often due to limited staff or tools.

Example: A seasonal UK bakery forecasts weekly during the holiday season to manage inventory, then shifts to quarterly forecasts off-season.

Best Practices for Financial Forecasting

To maximize forecasting effectiveness, follow these tips:

- Use Reliable Data: Ensure historical data is accurate and up-to-date.

- Incorporate Scenarios: Plan for best, worst, and likely outcomes to prepare for uncertainty.

- Leverage Technology: Use financial planning software for automation and insights.

- Collaborate Across Teams: Involve sales, procurement, and marketing for holistic forecasts.

- Update Regularly: Rolling forecasts keep projections relevant in dynamic markets.

FAQs About Financial Forecasting

Conclusion: Take Control of Your Business’s Future

Financial forecasting isn’t just a task—it’s a strategic superpower that empowers you to navigate uncertainty, optimize resources, and drive growth. By understanding its types, methods, and tools, you can make informed decisions, mitigate risks, and position your business for success in 2025. Whether you’re using real-time data for monthly updates or scenario planning for unexpected challenges, the right approach can transform your financial outcomes.