A Complete Guide to Building and Maintaining a Business Emergency Fund

No matter how well-established your business may be, there are always unexpected circumstances that can disrupt operations—be it a sudden drop in revenue, an equipment breakdown, or even a global crisis like the COVID-19 pandemic. This is why it’s critical to build a business emergency fund. Having a safety net can make all the difference in keeping your business afloat during tough times and ensuring that you don’t need to rely on high-interest loans or depleting your personal savings.

In this guide, we’ll explore why your business needs an emergency fund, how much to save, the best ways to build it, and where to keep your emergency savings. Let’s dive in!

What Is a Business Emergency Fund?

A business emergency fund is a cash reserve set aside specifically for unforeseen circumstances or unexpected expenses that could disrupt your business operations. These emergencies could include anything from equipment failure, seasonal drops in revenue, natural disasters, or even legal issues.

Just like an emergency fund for personal finances, a business emergency fund is designed to cover costs that aren’t part of your routine business operations, giving you a buffer to maintain stability in times of uncertainty.

Why Does My Business Need an Emergency Fund?

You might be wondering why your business needs an emergency fund. Here are a few reasons:

- Unexpected Events: The business world is full of risks. A sudden natural disaster, a drop in client demand, or a health crisis could severely affect your revenue and cash flow. Without an emergency fund, you could find yourself struggling to meet your obligations.

- Operational Continuity: With an emergency fund in place, you ensure that your business operations can continue without significant disruption. You can keep paying employees, settle utility bills, and ensure that inventory and supplies are consistently available.

- Avoid Debt: Without an emergency reserve, businesses often turn to credit or loans to cover short-term emergencies. This can be risky, especially if debt accumulates and compounds over time.

- Seizing Opportunities: An emergency fund isn’t just for disaster recovery. If an unexpected opportunity arises—such as a new product launch or an acquisition—having the funds available can help your business move quickly without causing financial strain.

How Much Should I Save in My Business Emergency Fund?

Determining how much to save in your emergency fund is one of the most critical steps. The amount will vary depending on your business needs, but a good rule of thumb is to aim for three to six months’ worth of operating expenses.

Factors to Consider:

- Fixed Costs: How much do you pay monthly for rent, utilities, payroll, insurance, and other regular expenses?

- Variable Costs: Include costs that change, such as inventory, marketing, and product supplies.

- Seasonality: If your business experiences seasonal fluctuations, you might need to save more to account for off-season periods.

- Cash Flow Stability: If you have predictable and stable revenue, your fund may be smaller. If you’re in an unpredictable industry, a larger emergency fund is necessary.

If your monthly operating costs total $15,000, aim to have at least $45,000 to $90,000 saved in your emergency fund to cover potential crises.

Where Should I Keep My Business Emergency Fund?

Your business emergency fund should be in a safe, accessible place. Here are a few options for where to keep your emergency savings:

1. Business Savings Account

A business savings account at a reputable bank is one of the safest and most accessible places to store your emergency fund. It allows you to earn interest while still being able to access the funds when needed.

2. Money Market Account

A money market account offers higher interest rates than a regular savings account. It’s a good option for businesses that want their emergency fund to grow while keeping the funds liquid and accessible.

3. Certificates of Deposit (CDs)

For businesses that can afford to lock away funds for a set period, a no-penalty CD offers higher interest rates. However, it’s crucial to choose a CD with no penalties for early withdrawal in case of a sudden emergency.

4. Prepaid Business Cards

A prepaid card is another option, especially for smaller emergency funds. The funds on the card are accessible quickly, but they’re separate from your day-to-day business funds.

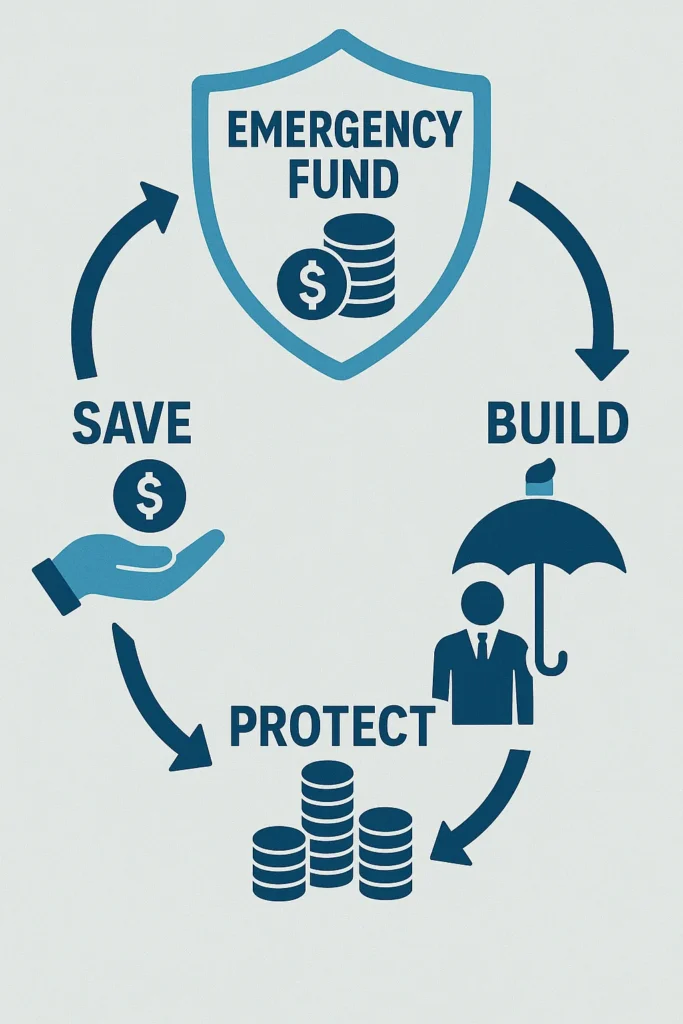

How to Build a Business Emergency Fund

Building an emergency fund takes time and consistency, but with the right approach, you can gradually create the financial cushion your business needs. Here are some steps to help you build your business emergency fund:

1. Set Clear Goals

Determine how much you want to save and set a timeline for when you hope to reach that goal. For example, you may aim to save $50,000 in the next 12 months. Having a clear target gives you something tangible to work towards.

2. Automate Your Savings

Just as you may automate other business expenses, set up automatic transfers from your business checking account to your emergency fund. This way, you can build the fund steadily without needing to manually transfer funds every month.

3. Cut Non-Essential Expenses

Review your business expenses regularly to identify areas where you can cut back. For example, you might find opportunities to reduce marketing costs or negotiate better deals with suppliers. Use the money you save to boost your emergency fund.

4. Use Extra Income or Windfalls

If your business has a particularly profitable month or receives a lump sum (e.g., a tax refund or one-time payment from a large client), consider putting a portion of that extra income into your emergency fund.

5. Treat It as a Priority

Saving for emergencies should be a non-negotiable expense in your budget. Don’t wait until the end of the month to see if there’s money left to save—ensure you’re saving before other expenses.

When Should I Use My Business Emergency Fund?

The key to a successful emergency fund is knowing when to use it. Use the fund only for unforeseen circumstances that are critical to keeping your business operational.

Acceptable Uses:

- Natural Disasters: If your business is affected by an event like a flood, fire, or earthquake, the emergency fund can help with repairs and immediate costs.

- Legal or Regulatory Issues: Use the fund to cover unexpected legal fees, fines, or compliance costs that could otherwise disrupt your operations.

- Equipment Breakdown: If a critical piece of machinery breaks down unexpectedly, use the fund to repair or replace it quickly without delaying your business processes.

- Sudden Drops in Revenue: If you lose a major client or experience a slow sales period, your emergency fund can cover operational costs like payroll and rent until your revenue picks up again.

What’s Not Covered:

- Routine operational expenses, such as monthly bills that can be forecasted.

- Non-emergency business expansions or investments, which should come from planned business funds.

FAQs About Business Emergency Funds

Conclusion

Building a business emergency fund is an essential step towards ensuring long-term financial stability and protecting your company from unforeseen disruptions. By setting clear goals, automating your savings, and using the fund responsibly, you can safeguard your business against unexpected expenses. Start small, stay consistent, and soon you’ll have the financial buffer your business needs to thrive.