R&D Tax Credits: A Startup’s Guide to Maximizing Financial Support

Research and Development (R&D) tax credits are a UK government incentive designed to foster innovation by providing financial relief to companies investing in scientific or technological advancements. Since their introduction in 2000, these credits have supported thousands of businesses, from startups to large corporations, by reducing Corporation Tax bills or offering cash payments. For startups, R&D tax credits are a lifeline, offsetting the high costs of innovation and extending cash runway, a critical factor given that 29% of startups fail due to cash shortages, according to CB Insights. This guide explores eligibility, qualifying costs, claim processes, recent changes, and strategies to maximize R&D tax relief, empowering startups to leverage this scheme effectively.

What Are R&D Tax Credits?

R&D tax credits reward UK companies for projects that seek to advance science or technology by overcoming scientific or technological uncertainties. Managed by HM Revenue & Customs (HMRC), claims are submitted as part of the Company Tax Return (CT600). Eligible businesses can claim up to 27% of their R&D expenditure, either as a tax reduction or, for loss-making startups, as a cash credit. This incentive is particularly valuable for startups with limited revenue, as it alleviates financial pressure, supports growth, and enhances competitiveness without diluting ownership, unlike venture capital or loans.

Key Eligibility Criteria

To qualify for R&D tax credits, a company must:

- Be registered for UK Corporation Tax and be a going concern.

- Have undertaken R&D projects aiming to advance science or technology.

- Have incurred qualifying R&D expenditure within the last two accounting periods.

- Face scientific or technological uncertainties that a competent professional in the field couldn’t readily resolve.

Projects in arts, humanities, social sciences (including economics), or routine improvements are ineligible. However, advancements in fields like software development, manufacturing, or pharmaceuticals often qualify, even if the project fails, as long as it addresses technological uncertainties.

R&D Tax Credit Schemes

HMRC offers two main schemes, which merged into a single system for accounting periods beginning on or after April 1, 2024, with an exception for R&D-intensive SMEs:

SME Scheme (Pre-April 2024)

- Target: Small and medium-sized enterprises (SMEs) with fewer than 500 employees, turnover under €100 million (£85 million), or balance sheet total under €86 million (£73 million).

- Benefits: Enhanced deduction of 130% (pre-April 2023) or 86% (post-April 2023) on qualifying costs, yielding up to 24.7% or 21.5% tax savings, respectively. Loss-making SMEs can surrender losses for a cash credit at 14.5% (pre-April 2023) or 10% (post-April 2023).

- Limitations: Excludes SMEs subcontracting for large companies or receiving specific R&D grants.

RDEC Scheme (Pre-April 2024)

- Target: Large companies or SMEs ineligible for the SME scheme.

- Benefits: Taxable credit of 10.5% (pre-April 2023) or 20% (post-April 2023) on qualifying costs, resulting in a net benefit of 8-16.2% after tax.

Merged Scheme (Post-April 2024)

- Target: All companies, regardless of size, for accounting periods starting on or after April 1, 2024.

- Benefits: Taxable credit of 20% on qualifying costs, yielding 15-16.2% net benefit, depending on the Corporation Tax rate (25% for profits over £250,000). Simplifies claims and includes subcontracted expenditure, even for large companies.

- Process: Treated as above-the-line credit, visible in financial statements, enhancing transparency.

Enhanced R&D Intensive Support (ERIS)

- Target: Loss-making SMEs with R&D expenditure ≥30% (post-April 2024) or ≥40% (pre-April 2024) of total costs.

- Benefits: Higher cash credit rate of 14.5%, offering up to 27% relief. Taxable, balancing fiscal responsibility and incentivizing profitability.

- Grace Period: One-year grace period for SMEs meeting intensity thresholds intermittently.

Retroactive claims for pre-April 2024 periods follow the older SME or RDEC rules, allowing up to two years from the accounting period’s end.

Qualifying Projects and Activities

A project qualifies if it:

- Seeks an advance in science or technology, such as developing new products, processes, software, or improving existing ones.

- Addresses scientific or technological uncertainties, where experts lack immediate solutions, e.g., optimizing algorithms for real-time data processing or creating waste-to-biofuel processes.

- Is undertaken by competent professionals, whose qualifications and experience must be documented.

Examples include:

- A software startup developing a novel data extraction process, qualifying due to its technological uncertainty (Myriad example).

- A manufacturing firm improving production efficiency with new materials, eligible for addressing process uncertainties (McIntosh example).

- An industrial process converting waste to biofuel, securing £82,570.25 in relief for overcoming significant challenges (Thomas case study).

Projects need not be publicly novel; advances unknown to the public but developed elsewhere still qualify. Mathematical advances are included as science since April 2023.

Qualifying Expenditures

Eligible costs must be expensed through the Profit & Loss account or, in some cases, capitalized. Common qualifying costs include:

- Staff Costs: Salaries, employer’s National Insurance, pension contributions, and reimbursed expenses for R&D staff.

- External Workers: 65% of payments to agency workers, subcontractors, or freelancers directly involved in R&D.

- Software and Cloud Computing: Licenses, data storage, and cloud services used exclusively for R&D, claimable since April 2023.

- Consumables: Materials, heat, light, power, and equipment transformed by R&D processes.

- Indirect Costs: Maintenance, security, administration, and feasibility studies directly supporting R&D.

Non-qualifying costs include rent, marketing, general overheads, or expenses not directly tied to R&D. For post-April 2024 claims, overseas subcontracted costs require careful tracking to separate UK expenditure, per HMRC’s new rules.

Benefits of R&D Tax Credits for Startups

R&D tax credits offer startups significant advantages:

- Cash Flow Boost: Tax reductions or cash credits (up to 27% for ERIS-eligible SMEs) extend runway, critical when 16% of startup failures stem from cash flow issues (Mullinix).

- Cost Offset: Recovering R&D expenses reduces financial strain, allowing reinvestment in hiring, marketing, or equipment.

- Competitive Edge: Faster innovation cycles place startups ahead of competitors, as seen in Thomas’s biofuel case.

- Investor Appeal: Successful claims signal dedication to innovation, attracting venture capital or angel investment.

- Sustainable Growth: Credits fund further R&D, supporting long-term viability without equity dilution, unlike loans or VC funding (McIntosh).

For example, a profitable SME spending £100,000 on R&D could save £21,500 in taxes, while a loss-making ERIS-eligible SME could receive up to £27,000 in cash credits.

How to Claim R&D Tax Credits

Claiming R&D tax credits involves meticulous preparation and adherence to HMRC’s processes. Here’s a step-by-step guide:

1. Assess Eligibility

- Confirm your company’s UK Corporation Tax registration and SME/large company status.

- Identify projects seeking scientific or technological advances and addressing uncertainties.

- Use HMRC’s guidelines or free assessment tools from providers like Myriad to verify project eligibility.

2. Notify HMRC (If Required)

- For accounting periods starting on or after April 1, 2023, submit a Claim Notification Form within six months of the accounting period’s end (e.g., June 2025 for January-December 2024). Exemptions apply if you’ve claimed within the last three years under the SME scheme.

- Provide company details, Unique Taxpayer Reference (UTR), senior officer contacts, agent details (if applicable), and a high-level summary of R&D activities.

3. Gather Documentation

- Project Descriptions: Detail the scientific/technological advance, uncertainties faced, and resolution methods, even for failed projects.

- Technical Narrative: Explain how competent professionals addressed uncertainties, supported by their qualifications and evidence of failed prior solutions.

- Financial Records: Track staff costs, consumables, software, and subcontractor expenses using timesheets, cost centers, or ledger codes.

- Tax Computations: Calculate qualifying costs and expected relief based on scheme rates.

4. Submit Additional Information Form (AIF)

- Mandatory since August 8, 2023, the AIF must be filed before or with the CT600, detailing technical and costing reports. Submit AIF first if filed on the same day to avoid rejection.

- Include narratives for all projects (if ≤3) or at least three projects covering 50% of costs (if ≥4).

5. File Company Tax Return (CT600)

- Submit the R&D claim within two years of the accounting period’s end, integrating AIF data and tax computations.

- HMRC targets 95% of claims for processing within 28 days, though processing typically takes 20-100 days, with payments arriving within 20 days post-approval.

6. Engage Specialists (Optional)

- Firms like FI Group, Myriad, or Alexander Clifford streamline claims, ensuring compliance and maximizing value. Myriad’s zero-risk guarantee covers HMRC challenges, while FI Group’s no-success-no-fee model minimizes risk.

Maximizing Your R&D Claim

To optimize claim value, startups should:

- Identify All Eligible Projects: Review all technical work, including routine activities with uncertainties, e.g., cloud computing or data licenses (claimable since April 2023).

- Track Costs Systematically: Use real-time systems like timesheets for staff costs, dedicated cost centers for consumables, and ledger codes for subcontractors. Post-April 2024, separate UK and overseas costs.

- Time Claims Strategically:

- File notifications within six months of the accounting period’s end.

- Use recent, accurate records to avoid retrospective documentation issues.

- Align R&D activities with accounting periods to capture maximum costs.

- Claim within the two-year window for retroactive periods.

- Document Thoroughly: Maintain up-to-date records of advances, uncertainties, staff qualifications, and project outcomes, as HMRC advises. Even first-time claimants should establish robust tracking systems going forward.

- Leverage Subcontractor Rules: Under the merged scheme, claim 100% of the lower of contractor payments or their relevant costs for connected parties.

Collaboration with R&D specialists can increase claim success. Alexander Clifford’s 2,400+ successful claims demonstrate the value of expert support in navigating HMRC’s stringent requirements.

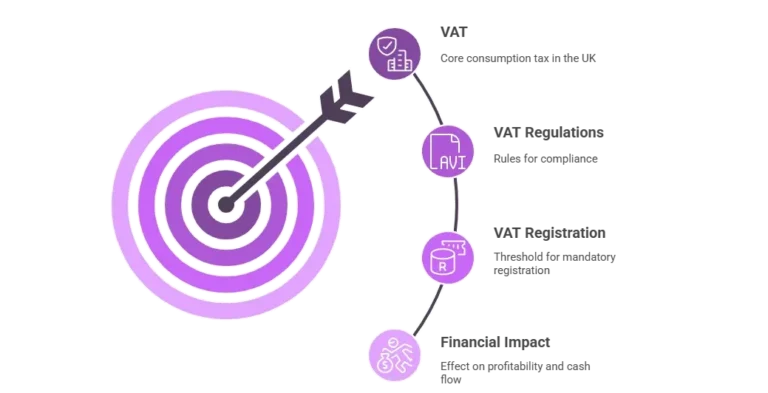

Recent Changes and Compliance

HMRC’s 2024 overhaul simplified the R&D landscape but tightened compliance:

- Merged Scheme: Unified SME and RDEC schemes with a 20% taxable credit, enhancing subcontracted cost inclusion.

- ERIS Scheme: Offers 27% relief for R&D-intensive SMEs, taxable to ensure fiscal balance.

- AIF Requirement: Mandatory pre-submission form since August 2023, reducing errors.

- Overseas Costs: Stricter rules for post-April 2024 claims, requiring UK expenditure separation.

- Increased Scrutiny: HMRC plans more rigorous checks, including interviews, site visits, and larger compliance teams to curb abuse, per McIntosh.

Startups must avoid common pitfalls, such as incomplete documentation or misclassified costs, to prevent rejections or reduced benefits. Pre-submission reviews by specialists like Myriad’s HMRC Enquiry Support Service ensure compliance.

Challenges and Considerations

- Complexity: The claim process requires detailed technical and financial reporting, daunting for first-time claimants without robust record-keeping.

- HMRC Scrutiny: Rising enquiries necessitate thorough documentation and specialist support to navigate challenges.

- Taxable Credits: ERIS and merged scheme credits are taxable, reducing net benefits but aligning with fiscal responsibility.

- Subcontractor Rules: SMEs subcontracting for large companies or receiving grants may be ineligible for the SME scheme, requiring RDEC or merged scheme claims.

Integration with Cash Flow Management

R&D tax credits directly support startups’ cash burn rate management, a critical factor in financial sustainability. By recovering up to 27% of R&D costs, startups can:

- Extend runway, aligning with the 12-18 month target recommended by experts like Efrat Kasznik.

- Reinvest in growth areas like product development or customer acquisition, per Tim Lipton’s advice to “pour on jet fuel” for high-return investments.

- Reduce reliance on equity financing, preserving ownership, as Stacey McIntosh notes.

- Offset high staff costs (often 60% of expenses, per Kasznik), a major burn rate driver.

For example, a SaaS startup with a $60,000 monthly net burn rate and five-month runway (re:cap example) could secure £82,570 in credits (Thomas case), extending runway by over a month. Combining credits with cost-saving strategies—like outsourcing non-essential tasks or negotiating payment terms (Graumann, Mullinix)—further optimizes liquidity.

Conclusion

R&D tax credits are a powerful tool for UK startups, providing financial relief, extending cash runway, and fueling innovation. By understanding eligibility, leveraging the merged or ERIS schemes, and meticulously tracking qualifying costs, startups can maximize claims worth up to 27% of R&D expenditure. Thorough documentation, strategic timing, and specialist support from firms like FI Group, Myriad, or Alexander Clifford ensure compliance with HMRC’s evolving requirements. As startups navigate cash burn challenges, R&D tax credits offer a non-dilutive funding source, enhancing competitiveness and supporting sustainable growth. With billions left unclaimed annually, startups must act promptly to capitalize on this opportunity and power their ideas forward.