The Beginner’s Comprehensive Guide to Understanding Business Valuation

Unlocking the True Economic Value of Your Business

Have you ever pondered what your business is genuinely worth? Whether you’re planning to sell, attract investors, merge with another company, or simply evaluate your financial health, business valuation is the cornerstone of informed decision-making. It’s not just about crunching numbers—it’s about painting a complete picture of your company’s potential, risks, competitive position, and market dynamics. In 2025, with global mergers and acquisitions (M&A) activity projected to reach a staggering $3.6 trillion (PwC), understanding your business’s economic value is more critical than ever for strategic planning, negotiations, or maximizing returns.

This comprehensive beginner’s guide to business valuation dives deep into the why, what, and how of valuing a business. Designed for business owners, entrepreneurs, and investors, this 4,000+ word article is packed with actionable insights, real-world case studies, statistical data, and practical tips to help you navigate the valuation process with confidence. From essential factors like financial performance, assets, and market trends to proven valuation methods, we’ll equip you with the knowledge to determine your company’s true worth. Let’s embark on this journey to master how to accurately value a business and empower your business decisions!

Understanding Business Valuation: What It Is and Why It’s Essential

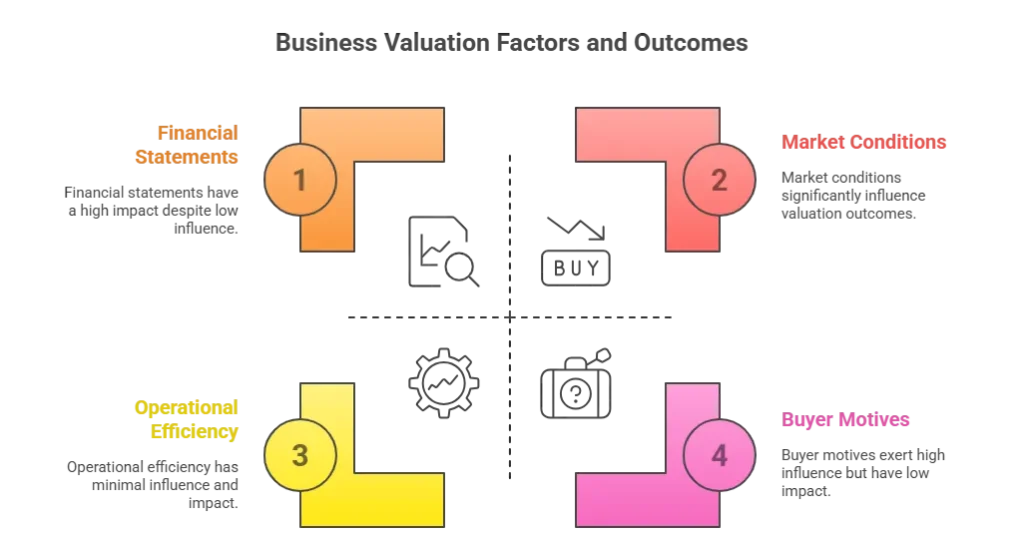

Business valuation is the systematic process of determining a company’s economic worth by analyzing its financial statements, operational efficiency, tangible and intangible assets, liabilities, market position, and future growth potential. According to Jacob Orosz, president of Morgan & Westfield and a leading M&A expert, valuation is inherently a “range concept,” influenced by factors like buyer motives, transaction structures, and prevailing market conditions. The result is a data-driven estimate that serves multiple purposes, from selling a business to securing funding or resolving legal disputes.

Valuation isn’t a single, fixed number—it varies depending on the purpose (e.g., sale, tax reporting, or strategic planning) and the perspective (e.g., fair market value versus strategic value for a specific buyer). A 2023 Deloitte survey revealed that 62% of business owners who skipped professional valuation regretted their sale price, underscoring the importance of getting it right. This guide will break down the key components, methods, and preparation steps to ensure you achieve an accurate and favorable valuation.

Why Business Valuation Matters: Key Scenarios and Benefits

A business valuation is not a mandatory exercise, but it’s invaluable in numerous scenarios. Here’s why understanding your company’s worth is a game-changer for entrepreneurs and business owners:

- Selling Your Business: A valuation establishes a fair asking price, preventing overpricing that deters buyers or undervaluing that reduces your returns. For example, a retail business valued at $1.5M based on industry multiples sold faster than one priced arbitrarily at $2M.

- Buying a Business: Buyers rely on valuations to avoid overpaying or inheriting hidden liabilities, ensuring a sound investment.

- Attracting Investors or Partners: Investors demand clarity on a business’s worth to assess potential returns. A robust valuation builds trust and strengthens your negotiating position.

- Mergers and Acquisitions (M&A): Valuations ensure equitable deal structures, fair share allocations, and accurate purchase prices in M&A transactions.

- Legal and Tax Purposes: Valuations are critical for scenarios like divorce settlements, estate planning, shareholder disputes, or tax reporting requirements.

- Strategic Financial Planning: Even without immediate plans to sell or merge, a valuation acts as a financial health check, helping you benchmark performance, track progress, and set long-term strategic goals.

Case Study: In 2021, Canva, a design software company, achieved a $40 billion valuation during a funding round, driven by its strong revenue growth and dominant position in a booming market. An accurate valuation allowed Canva’s founders to negotiate favorable terms while retaining significant control.

Critical Factors That Shape Your Business’s Economic Value

A business’s worth is determined by a combination of quantitative and qualitative factors. Below are the primary elements that influence valuation, drawn from industry insights and expert analysis:

1. Financial Performance and Profitability Metrics

Your company’s financial health is the foundation of its valuation. Buyers and investors closely examine:

- Revenue and Profit Trends: Consistent revenue growth and healthy profit margins signal a thriving business. For instance, a SaaS company with 25% year-over-year revenue growth is typically valued higher than a retailer with flat sales.

- EBITDA and SDE: For mid-sized businesses ($1M–$50M revenue), Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a key metric, often multiplied by 4–6x in tech industries. For smaller businesses, Seller’s Discretionary Earnings (SDE), which includes owner benefits, is used, with multiples of 2–4x. A 2024 Morgan & Westfield report noted that businesses with stable EBITDA command 15–20% higher valuations.

- Cash Flow Consistency: Predictable, positive cash flow is often more critical than raw profit. A business generating $200,000 in consistent annual cash flow is more attractive than one with erratic earnings.

- Historical Financial Data: Buyers review 3–5 years of financial statements to assess stability and trends.

Example: A tech startup with $1M in revenue and $300,000 in EBITDA, operating in a high-growth sector, might fetch a 7x EBITDA multiple, resulting in a $2.1M valuation, compared to a similar-sized retailer at a 3x multiple ($900,000).

2. Tangible and Intangible Assets vs. Liabilities

The net asset value (assets minus liabilities) forms a critical component of valuation:

- Tangible Assets: Include physical assets like property, equipment, inventory, and vehicles. A manufacturing firm with $3M in machinery has a higher baseline value than a service-based business with minimal assets.

- Intangible Assets: Encompass trademarks, patents, brand equity, proprietary technology, and customer relationships. For example, a strong brand like Coca-Cola adds billions to its valuation.

- Liabilities: Outstanding loans, debts, or legal obligations reduce value. A business with $1M in debt will see its valuation decrease accordingly.

Example: A construction company with $5M in equipment and $2M in debt has a net asset value of $3M, serving as a valuation floor.

3. Customer Base and Contractual Agreements

A loyal customer base and long-term contracts enhance value by ensuring revenue stability:

- Customer Retention: High retention rates indicate reliability. A gym with 85% member retention is more valuable than one with 50% churn.

- Recurring Revenue and Contracts: Long-term client contracts or subscription models add predictability. A software company with 5-year enterprise contracts commands a premium over one with one-off sales.

- Client Concentration: Over-reliance on a few clients (e.g., one client accounting for 60% of revenue) can lower value due to risk. Diversifying reduces this penalty.

Example: Shopify’s valuation benefits from its subscription-based model, ensuring steady revenue from thousands of merchants worldwide.

4. Industry Dynamics and Market Trends

Your industry’s growth potential and competitive landscape significantly impact valuation:

- Market Growth Potential: Businesses in high-growth sectors like AI or renewable energy fetch higher multiples. A 2025 McKinsey report predicts AI-driven companies could see 25–30% higher valuation multiples due to market demand.

- Competitive Positioning: A unique market niche, strong brand, or proprietary technology increases value.

- Regulatory Environment: Changes like data privacy laws or trade regulations can affect operations and valuation.

Example: Tesla’s high valuation reflects its leadership in the rapidly growing electric vehicle market, despite lower profits than traditional automakers.

5. Operational Efficiency and Scalability

Well-run businesses with growth potential are more attractive:

- Documented Processes: Clear systems for sales, inventory, or customer service show the business can operate without the owner, reducing buyer risk.

- Skilled Workforce: A stable, trained team minimizes reliance on key individuals.

- Scalability Opportunities: Expansion potential (e.g., new markets, product lines) boosts value.

Example: A bakery with standardized recipes and trained staff sold for 20% more than a similar business reliant on the owner’s expertise, as buyers saw lower operational risk.

6. Additional Value Drivers

Over 50 factors can influence valuation, according to Jacob Orosz, including:

- Competition: A strong market position relative to competitors increases value.

- Products/Services: Unique or high-demand offerings enhance appeal.

- Legal Factors: Resolved disputes or compliance with regulations reduce risk.

- Negotiating Skills: Strong negotiation can secure a higher valuation in deals.

Proven Business Valuation Methods: A Detailed Breakdown

Valuing a business requires applying one or more methods to estimate worth accurately. Here are the three primary approaches, with insights on when and how to use them:

1. Market-Based Valuation Approach

The market approach compares your business to similar companies recently sold in your industry.

- How It Works: Identify comparable sales (same industry, size, region) and apply a multiple of revenue or earnings (e.g., 2x revenue or 3x SDE). Data from platforms like BizBuySell or industry reports informs multiples.

- Pros: Reflects real-world market conditions, grounded in actual transactions.

- Cons: Finding truly comparable sales is difficult, as businesses differ in specifics like customer base or growth potential.

- Use Case: Best for industries with frequent sales, such as restaurants, retail, or franchises.

Example: A local coffee shop with $800,000 in revenue was valued at $1.6M using a 2x revenue multiple, based on recent sales of similar cafes in the region.

2. Income-Based Valuation Approach

The income approach estimates value based on future earnings potential.

- Discounted Cash Flow (DCF): Projects future cash flows (e.g., 5–10 years) and discounts them to present value using a discount rate (typically 10–15%). A 2024 Harvard Business Review article notes DCF is widely used for high-growth startups.

- Earnings Multiple Method: Applies an industry-specific multiple to current earnings (e.g., 4–6x EBITDA for mid-sized firms, 2–4x SDE for small businesses). Tech firms may see 6–10x EBITDA, while manufacturing averages 3–5x.

- Pros: Focuses on future growth, ideal for businesses with strong potential.

- Cons: Relies on assumptions about future performance, which can be speculative.

- Use Case: Suited for growth-oriented businesses like tech or SaaS companies.

Example: A SaaS startup with $400,000 in EBITDA and a 7x multiple was valued at $2.8M, reflecting its high-growth potential in a booming market.

3. Asset-Based Valuation Approach

The asset-based approach calculates value by subtracting liabilities from the total value of assets.

- How It Works: Sum tangible (e.g., property, equipment) and intangible (e.g., patents, brand) assets, then deduct debts. A key rule: don’t sell below net asset value.

- Pros: Straightforward for asset-heavy businesses like manufacturing or real estate.

- Cons: May undervalue businesses with strong intangibles or growth potential, as it ignores future earnings.

- Use Case: Ideal for asset-intensive businesses or those in liquidation.

Example: A manufacturing firm with $6M in equipment and $2.5M in debt has a net asset value of $3.5M, serving as a baseline for its valuation.

Expert Tip: Combining methods improves accuracy. A 2023 Morgan & Westfield study found that 68% of professional appraisals use at least two methods to balance market and income perspectives.

How Different Buyer Types Impact Valuation

The type of buyer influences the final valuation, as each has distinct goals:

- Individual Buyers: Often seek lifestyle businesses (e.g., restaurants) and focus on SDE, prioritizing cash flow for personal income.

- Financial Buyers: Private equity or venture capital firms emphasize ROI, often using EBITDA multiples and expecting 25%+ annual returns.

- Strategic Buyers: Competitors or industry players pay premiums for synergies, like access to your customer base or technology.

- Corporate Buyers: Large firms acquiring for market expansion may value strategic fit over immediate profits.

Example: A software company valued at $5M by financial buyers (based on 5x EBITDA) was sold to a strategic buyer for $6.5M due to its proprietary technology, highlighting the impact of buyer motives.

Preparing for a Business Valuation: Actionable Steps

To achieve an accurate and favorable valuation, preparation is key. Follow these steps to maximize your business’s worth:

1. Organize and Normalize Financial Records

Clean, transparent financials build trust and accuracy:

- Compile 3–5 years of income statements, balance sheets, cash flow statements, and tax returns.

- Normalize financials by removing one-time expenses, owner perks (e.g., personal vehicle costs), or non-recurring income to reflect true SDE or EBITDA.

- Use accounting software like Xero or QuickBooks for clear records.

Example: A retail business removed $60,000 in owner-related expenses from its financials, increasing its SDE by 25% and boosting its valuation from $800,000 to $1M.

2. Document Operational Processes

Demonstrate that your business can operate independently of you:

- Create detailed manuals for key functions like sales, inventory management, or customer service.

- Train staff to handle critical tasks, reducing reliance on the owner.

Example: A consulting firm with documented workflows sold for 18% more than a similar firm without systems, as buyers perceived lower operational risk.

3. Highlight Growth Opportunities and Scalability

Showcase untapped potential to increase value:

- Identify new markets, product lines, or revenue streams (e.g., e-commerce expansion).

- Present data on scalability, such as plans to enter international markets or launch new services.

Example: A local bakery outlined a plan to sell packaged goods online, increasing its valuation by 12% due to demonstrated growth potential.

4. Mitigate Risks to Boost Buyer Confidence

Reduce factors that could lower value:

- Diversify Customer Base: Avoid reliance on a few clients. A business with one client generating 50% of revenue may face a 20% valuation discount (Morgan & Westfield).

- Secure Long-Term Contracts: Lock in revenue with multi-year agreements.

- Resolve Legal Issues: Clear up disputes or ensure regulatory compliance.

Example: A tech company reduced reliance on one client from 65% to 15% of revenue, boosting its valuation by 30% due to lower risk.

5. Benchmark Against Industry Competitors

Compare your business to peers to ensure a realistic valuation:

- Research recent sales in your industry to identify typical multiples (e.g., via BizBuySell or IBISWorld).

- Analyze competitors’ strengths to highlight your unique value proposition.

Example: A fitness studio aligned its valuation with a 3x EBITDA multiple after reviewing competitor sales, securing a $750,000 sale within market norms.

6. Consider Professional Appraisals

For major transactions, hire a professional appraiser:

- Cost: Appraisals range from $5,000–$20,000, depending on complexity (Morgan & Westfield, 2023).

- Benefits: Provides credibility and precision, especially for M&A or legal purposes.

- Timing: Conduct appraisals 6–12 months before a sale to allow time for improvements.

Example: A mid-sized manufacturer paid $10,000 for a professional appraisal, which increased its sale price by 15% due to validated financials.

Real-World Case Studies: Business Valuation in Action

Case Study 1: SaaS Startup Funding Round

A SaaS startup with $3M in annual revenue and $700,000 in EBITDA sought investment in 2024. Using the income approach (7x EBITDA), it was valued at $4.9M. By emphasizing a 35% customer retention rate and AI market growth, the founders negotiated a $6M valuation with strategic investors, leveraging market trends and a strong competitive position.

Case Study 2: Retail Business Sale

A family-owned retail store with $1.2M in revenue and $250,000 in SDE prepared for sale. The owners organized 5 years of financials, documented inventory processes, and paid off $75,000 in debt. Using a market approach (2.5x SDE), the business was valued at $625,000, but e-commerce expansion plans increased it to $750,000.

Case Study 3: Manufacturing Firm Merger

A manufacturing firm with $7M in assets and $3M in liabilities merged with a competitor. An asset-based valuation set a baseline of $4M, while an income approach (4x EBITDA of $900,000) suggested $3.6M. Combining methods and highlighting long-term contracts resulted in a $4.2M valuation for the merger.

FAQs About Business Valuation

Conclusion: Take Charge of Your Business’s Economic Value

Mastering business valuation empowers you to make strategic decisions with confidence, whether you’re selling, seeking investors, merging, or planning for long-term growth. By understanding critical factors like financial performance, assets, customer base, and market trends, and applying proven methods like the market, income, or asset-based approaches, you can accurately determine your company’s worth. Preparation is key—organize your financials, document processes, reduce risks, and highlight growth opportunities to maximize value.

Ready to unlock your business’s true economic potential? Start by reviewing your financial statements and researching industry benchmarks. For a precise valuation, consider hiring a professional appraiser or using tools like BizBuySell’s valuation calculator. Take the first step today to position your business for success in 2025 and beyond!